200 years of shipping expertise teamed up with local knowledge

member of PGS Group

PGS EXP has set up a clear procedure and knows the complexity for the customs clearance at destination. PGS EXP has strong customs broker partners in all major Amazon warehouse areas.

Therefore, when we need to deliver the goods to Amazon FBA warehouse, we need a broker, local company or individual as notify party besides Amazon written as consignee. Otherwise, the goods might be return to China with high cost.

It’s clear to be shown on the commercial invoice: AMAZON as consignee followed by SHIP TO; Broker or other local company is SOLD TO. Please mark the SHIP TO well to avoid mistakes. There are mainly two types of issues of FBA shipments: DUTY and CUSTOMS CLEARANCE. In order to avoid problems, the shipper should follow the instructions below:

1. Before delivery, shipper should notify the importer about customs clearance and the receipt for the shipment to make sure that the notify party (SOLD TO) would assist Amazon or brokers to deal with the customs clearance.

2. The real importer’s (buyer or broker) company name, address, contact person, contact information (telephone, cell or email)should be marked well in the commercial invoice.

3. Due to Amazon not providing any customs clearance or tariff prepaid services, in order to avoid any delay, before the delivery, please confirm the payer of tariff. We suggest tariff prepaid or paid by the third party.

4. In order to avoid any mistake or omitting, shipper and importer should coordinate with each other to confirm the goods arrive at the FBA warehouse safely. If mistake or omitting occurs, importers or consignees wouldn’t/couldn’t provide detailed information, Amazon would not investigate the process. This would lead to be unable to claim loss and the total charge would be afforded by the shippers.

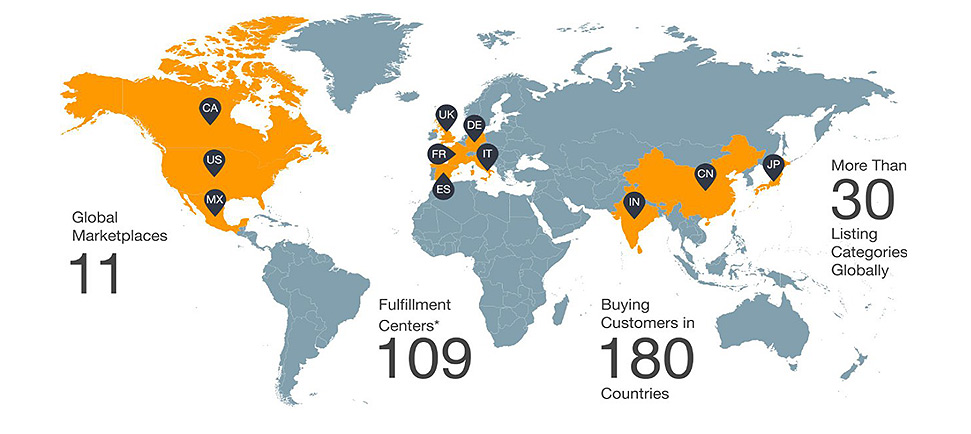

PGS EXP has contracted partners with many years of cooperation all over the world. In particular, the countries where Amazon is present:

The United States, United Kingdom, Germany, Canada, France, Spain, Italy, Australia, and Mexico.

For all these destinations we have worked out a clear tariff and shipping procedure

PGS is famous on our strong capability of customs clearance. Relied on PGS global network of agencies, all the FBA goods can be tracked and operated seamlessly, especially in the countries below: USA, UK, Germany, Canada, France, Japan, Spain, Italy, Australia and Mexico.

PGS has partner airlines and integrators with over 100 flights per week from China.

It takes about 5 working days from China main area to the FBA warehouses in the United States and Western European countries. PGS EXP offers consolidated air services to achieve the best possible rates but also offer single shipment dispatch.

services to achieve the best possible rates but also offer single shipment dispatch.

PGS EXP has 2 weekly closings for sea freight services to the United States and Europe. PGS EXP arranges the pre-inspection in China and prepares all documents for the clearance process.

The transit time, port to port to the US is 15-18 days and Europe 25-30 days.

The reality is that most of the sellers are from overseas, they cannot handle these products. They can do nothing but wait. In this case, the surplus goods would become more and more. Except the extra storage charge and destroy fee by Amazon, the loss also includes payment of goods, labeling cost, freight fee, customs duty, FBA charge and potential profits. Handling surplus goods becomes one of the most troublesome issues for Amazon oversea sellers. Even if Amazon helps return the goods, there is no space to handle.

Returning back to China would spend a huge amount of freight fee; destroying the goods also would be a big loss; keeping in the warehouse would be charged storage fee. Please leave your products to PGS! PGS is another home of your products. PGS helps you out of the paradox of the above.

PGS provides repacking, label changing, transport and re-sell services in USA, Canada, UK, Germany, Spain, France and Japan. Our agencies all over world and colleagues working in oversea warehouses are familiar with Amazon’s rules, and they can handle label changing, packaging and transport quickly while receiving the returns. With PGS, you can maximize the benefits from all your products.

※ Do you still transfer your goods from UK or Netherlands to Germany and Spain? Do you want to send the goods to Germany and Spain directly?

Whether you have VAT or not, we can provide customs clearance and local delivery service in Germany and Spain.

※ Do you still worry about VAT application?

Our professional accountant team would provide VAT application service for you.

※ Do you still search for services of VAT maintenance?

When you have the VAT No., you need to do the accounting and tax declaration. We can do it for you safely and professionally!

※ Can you seek out some accountants who are easy to be communicated and cost-effective?

Our professional accountants can provide international level services with local languages.

※ Do you still worry about the Amazon returns without any contact person in EU?

We provide all kinds of services including Amazon returns handling, temporary storage, repacking and maintenance.